Posts

You might lead a complete matter since you attained more than 4,five hundred at the TR. The newest contribution limit is actually broke up equally among them of you unless you acknowledge an alternative section. Your otherwise your employer can also be contribute to 75percent of the annual allowable of the HDHP (65percent when you have a personal-only plan) for the Archer MSA. You must have the new HDHP all-year so you can contribute an entire amount. For reason for and make efforts so you can HSAs away from low-very settled team, extremely compensated team is almost certainly not addressed because the similar acting team. There is absolutely no more tax on the withdrawals produced following the go out you’re disabled, come to ages 65, or pass away.

Savings account: slot jack hammer 2

Find set of acting banking companies in the SoFi.com/banking/fdic/participatingbanks. This is basically the only financial to your all of our listing that has many away from financial twigs, in addition to its cafes, whilst providing an aggressive give for the its savings points. If you’d like to have the option out of talking to a person in the flesh, that it family savings could be most effective for you. To access the newest eligibility criteria for sponsoring a teenager, please go to the brand new Backed Profile area of the Cash Software Words away from Provider.

Simple tips to earn Go2Bank recommendation added bonus

Talking about all the good reasons why you may not manage to arrange lead dumps together with your financial. Update is another online financial that provides added bonus dollars after you unlock a different bank account. You’ll earn 200 once joining an advantages As well as Family savings. No action becomes necessary for eligible taxpayers to get these types of money, which will day instantly in the December and may arrive in many cases from the late January 2025.

This consists of establishing repeating transmits from your checking in order to your bank account. Deals and you may MMAs are fantastic alternatives for people seeking save for reduced-identity needs. They have been a safe treatment for independent your deals of informal bucks, but could need huge minimal balances and also have transfer constraints.

- Yet not, the brand new FDIC suggests one establishments fill in its Label Report to possess Summer 29, 2024, ahead of submitting the newest SOD survey, allow evaluations from deposit totals between them accounts.

- If federal earnings, personal defense, or Medicare taxes that needs to be withheld (which is, faith money fees) aren’t withheld or are not deposited or paid back for the U.S.

- Because the a normal user during the McLuck, you could holder upwards a lot of free Sc.

- Members just who install head deposit have the option to help you discover the paychecks up to 2 days very early ⁴, and in case it receive at the least 1,one hundred thousand the 1 month, they’re going to be eligible for to 50 inside overdraft coverage ⁵.

- The newest agreement can be applied in order to the newest taxation form upon which they looks.

The fresh membership also offers Savings Roundups, and this automatically rounds upwards checking sales on the nearest money and you may contributes those funds to your bank account. If you’d like an area in order to securely shop finances as opposed to worrying all about costs, a free checking account with no starting put needs is actually an excellent great option. Total financing and book balances increased because of the 275.5 billion (dos.2 percent) in the earlier seasons. The new yearly increase try led because of the finance so you can NDFIs (up 112.9 billion, or 14.4 per cent) and you may mastercard finance (upwards 62.2 billion, otherwise 5.9 per cent). A powerful greater part of banking institutions (81.dos percent) advertised yearly mortgage progress. Really gambling enterprises undertake multiple options, and Interac, handmade cards, debit notes, e-purses, prepaid cards, and.

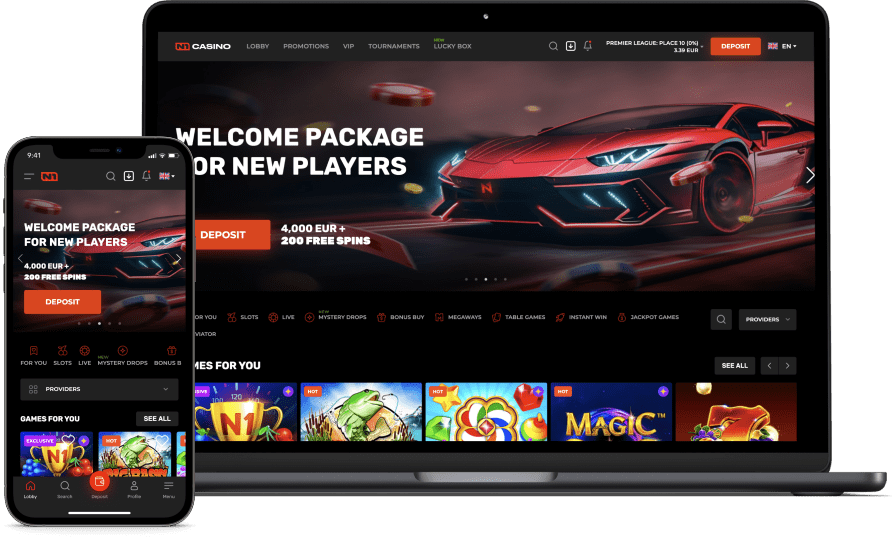

Their very first experience of the newest gambling establishment can be been when they talk about this give. There are several issues you to differentiate a knowledgeable gambling enterprise slot jack hammer 2 advertisements. These types of feature sensible terms and conditions – betting requirements below 15x, validity between 7 and you will thirty days, and lots of qualified games. Should your extra of the attention fits it breakdown, you happen to be all set. We founded a totally free extra calculator so you can decide if an offer’s worth it.

All of our knowledge of Lie Bank’s bank account

You’re qualified to receive a profit added bonus after you done expected issues – just click here for information. Lauren Ward is a writer whom talks about everything private finance, and financial, a house, small businesses, and more. The new views, analyses, ratings otherwise guidance indicated on this page are those of your own Blueprint article staff alone. Every piece of information try direct as of the newest publish time, however, always check the brand new merchant’s webpages for the most newest guidance.

You can get ready the fresh taxation get back on your own, find out if you be eligible for totally free tax thinking, or get an income tax professional to set up the go back. The newest contribution can be’t be paid thanks to a good voluntary income prevention agreement to your section of a worker. Workers are reimbursed tax free for qualified scientific expenses as much as a maximum buck matter to possess a shelter period.

Once you shell out scientific expenses in the year one aren’t reimbursed by your HDHP, you could potentially ask the newest trustee of one’s HSA to deliver your a distribution from your HSA. You will want to receive Setting 5498-SA, HSA, Archer MSA, or Medicare Virtue MSA Guidance, in the trustee showing the quantity resulted in your HSA throughout the the entire year. Your boss’s efforts is likewise revealed on the Mode W-2, package twelve, code W.

Members of the family or any other people may create efforts on the part from a qualified individual. You could have visibility (if offered due to insurance or otherwise) for the following points. There are a few loved ones preparations which have deductibles for the family members as a whole and for private members of the family.

These may be offered in addition to most other boss-provided professionals as part of a cafeteria plan. Employers features freedom to give various combos of advantages in the creating the agreements. That it point contains the regulations you to companies must go after if they decide to generate Archer MSAs accessible to their workers. Unlike the earlier talks, “you” refers to the employer rather than to your personnel. You start with the first week you’re subscribed to Medicare, you could’t subscribe to a keen Archer MSA. But not, you are eligible for a Medicare Advantage MSA, chatted about later.

The new Irs and reminded taxpayers who refuge’t submitted 2021 tax returns they are eligible as well, but they face an enthusiastic April 15, 2025, deadline to help you document the production in order to allege the credit and people other refund they have been owed. Whether your document digitally or written down, direct put will provide you with entry to their reimburse smaller than simply an excellent papers consider. Somebody can observe the quantity of their third Financial Impression Payments as a result of the personal Online Account. Because of March 2022, we’re going to as well as posting Letter 6475 on the target we have for the apply for you confirming the total amount of your 3rd Economic Effect Fee and you can one as well as-right up payments your received to possess taxation seasons 2021. Most eligible people already acquired its Financial Effect Payments. Yet not, people who are forgotten stimulus costs is to opinion all the information less than to decide its qualifications so you can allege a healing Discount Borrowing from the bank to possess income tax season 2020 or 2021.